Getting involved in one of them safeguards a few of your possessions if you must require Medicaid in the future. There may be other benefitsyour state's Medicaid office will have more details.

Long-term care insurance coverage actions in if you develop a health condition that requires you to get care and guidance. This could indicate house health care, nursing house care or personal or adult daycare. Many individuals wrongly believe that Medicare or Medicaid would cover their care expenses, however this is often not the case.

Long-term care insurance is worth it since it safeguards your possessions, spares your household from financial and emotional stress, and puts you in control of your health choices.

With infant boomers reaching retirement age en force, a great deal of attention has been provided to their health care and long term care needs especially the cost of care. And as with any big pricey requirement in our lives, insurance coverage have actually been produced to reduce the cost of these services, in what's called long term care insurance (LTC insurance coverage for brief).

How To File An Insurance Claim Things To Know Before You Get This

Long term care policies have quite costly premium costs, making them uninviting to medicaid qualifying people (who may have a subsidized cost of care), and financially inefficient for those rich enough to self guarantee. To get a much better understanding of why you might or may not require long term health care insurance, it initially makes sense to break down it down into its two parts: long term care as a service and long term care insurance as a way of spending for it.

gov, long term care is "a variety of services and supports you might require to fulfill your personal care requirements." The majority of long-lasting care is not healthcare, but rather help with the standard individual jobs of daily life. Examples of long term care consist of assisted living home care, helped living facilities and home care.

While long term care is not medical in nature, it is frequently required most by those suffering devastating medical conditions like strokes, Parkinsons, or Alzheimer's. However, aging captures up to everyone, and the American Association for Long Term Care Insurance Coverage predicts 68% of individuals who are 65 or older will require long term care.

It may be unsurprising then that 10 million Americans currently have long term care insurance. Unfortunately for those who need it, not just can long describe care be rather expensive, but the expense of care has likewise been increasing in time. how much insurance do i need. Estimates presently vary from a typical yearly expense of $43k for care in a nursing home, to $92k for a private space website in an assisted living home.

An Unbiased View of How To Get Dental Implants Covered By Insurance

To put it merely, many people do not "choose" long term care because they desire to. It is usually a necessity predicated by one's inability to care for themselves. Rising long term care costs that significantly surpass inflation have made it financially harder for lots of to manage long term care, even if they want to manage it.

Insurance coverage is well liked by financial experts and financial advisors as it supplies defense against very expensive and extremely unlikely occasions. A flat monthly cost permits intake smoothing, as it has actually been shown a lot more beneficial to part with $100 on a monthly basis, then $100,000 all at as soon as, even if that only happens once in your life.

Long term care insurance coverage is various as it's somewhat foreseeable. You understand you will get old, and you understand you will probably require some care. Additionally, long term care insurance plan have differing benefit durations, waiting times and premium costs associated with them. As such it's not something as foreseeable as vehicle insurance (which typically has a maximum payment of the total worth of the vehicle) or life insurance (which pays a specific quantity specified in advance).

Because of that LTC insurance coverage does have a couple of disadvantages. The first, is your long term care insurance coverage might not completely cover your specific requirements. You could purchase a policy that pays a day-to-day advantage of $150 for the very first 3 years, just to discover the expense of care has increased substantially more than that, or that you require more pricey care for a much shorter period of time.

How To Find A Life Insurance Policy Exists Can Be Fun For Everyone

Compounding that problem is the reality that many standard long term care policies have an elimination period of 90 days, meaning you'll need to cover yourself during this time period (consider it as comparable to a deductible). This can leave some policyholders losing out, as 60 percent of elders remain in nursing houses for less than 90 days.

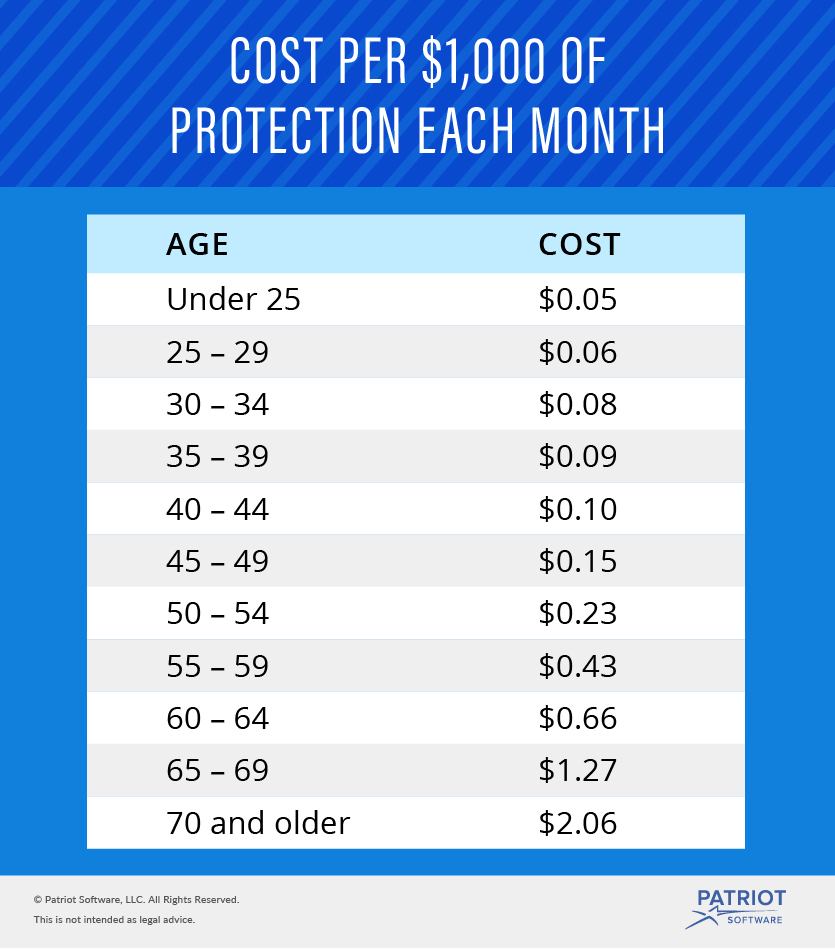

Now that you understand what long call care is, and the yearly expenses connected with it, we can provide some guidance on when it might be a good concept to get long term insurance coverage. First, it's best to get long term care insurance when you're young. Similar to life insurance or medical insurance, the older you are, the riskier your policy is considered, and the higher your premiums.

Not just that, but if you wait to apply for long term care insurance coverage when you understand you need it, you're likely to get denied. That being stated, you don't wish to be too young (most life insurance companies will not even let you use if you're under 30). A great way to examine the worth you're getting for your long term care insurance coverage is to compare it to self-insuring through savings over the very same duration of time.

Putting the very same quantity in a mutual fund with an average rate of 5. 5% compounded monthly, would yield $106,411 in cost savings by age 65. This is a little less than long term care insurance, however with a lot more versatility on how to invest. If you don't wind up needing long term care, that cash is still all yours to spend.

The Single Strategy To Use For How Much Is Health Insurance A Month For A Single Person?

A substantial amount still to have for cost savings, but a third as much protection for long term care. The main trade off between LTC insurance and self insuring is is how much you value the versatility of having the ability to invest your own savings, compared to the peace of mind of understanding you'll get a higher coverage amount must you require long term care.